Seven c Premium #22 🏴☠️

JUST IN: Crypto’s hottest trends + trading education (free preview). Find your edge here.

Welcome to the 22nd edition of Seven c Premium.

In today’s episode I’ll be showcasing the trading education content for free to give you a taster of what you can expect every week (scroll down).

But first…

Let’s see how the 21st edition of Seven c Premium performed in the last week whilst Bitcoin managed a -1.1% week:

2DAI up 69%, AAVE up 7%, PEPE up 5%, ASTX up 88.6%, RLB up 7%, FET up 50%, MOBY up 140%, VAULT up 23%, BANANA up 27%, OLAS up 7%, SINU up 224% (last 24h), AEGIS up 12%, ROKO up 15%, PAAL up 16%, ENQAI up 80% truth be told, this newsletter provides consistent alpha most of the time, you just need to utilise it, what alpha?

Elite Insights: Navigate the crypto seas with smart money strategies and exclusive alpha insights.

Innovative Discoveries: Be the first to find new protocols and emerging trends.

Market Mastery: Master the art of reading money flows, TVL movements, and token dynamics.

Strategic Edge: Gain insights into top narratives and protocols that shape the market.

Lucrative Opportunities: Find the highest-yield on ETH & stables.

Community of Conquerors: Join forces with like-minded pirates in our exclusive Discord haven.

Trading Education: Stoic provides elite trading education, in fact just a few weeks ago he was providing education on why $44k Bitcoin was so bullish if we break through, and here we are at $50k+.

Keep scrolling down for your FREE preview… if you like what you see and want to keep reading to extract max value, then claim a 7-day free trial before you get the cheap price (less than two fancy coffees a month) of £9.99 a month.

A discord server for premium members to chat to me and eachother:

Note, this is not a service you are paying for but merely a bonus that some of you requested, you are paying for the analytics delivered to you, I can’t be active 24/7 there but will do my best to get back to you guys and provide some insights through the week.

When you arrive link your premium account to Substack email for premium access.

The following information has been gathered from Stoic, DeFi Llama, ChainEDGE, and Token Unlocks.

Contents:

1: Stoic’s trading corner + education (free preview today)

2: Smart money

3: New protocols

4: Money flows

5: Token unlocks

6: Top narratives

7: Top yields

8: Tutorials (how to utilise the newsletter)

1: Stoic’s trading education corner

Stoics Trading Corner, trading education to level you up + learning Bitcoin levels to keep an eye on this week, must read:

Market is a conglomerate of positions that are dynamic in nature.

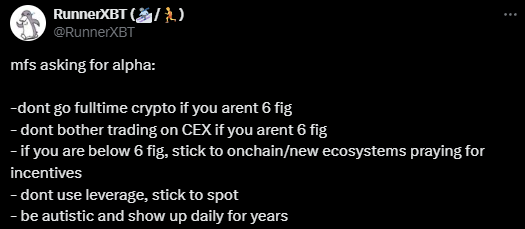

Great thread discussing edge and a perspective on how to view the market.

Alpha Thread

I don’t necessarily agree with needing 6 figs to start trading on a CEX or praying for incentives if you’re under 6 figures.

I believe it all depends on your goals. You can start learning how to trade with less capital and pay tuition as a learning experience with a far smaller portfolio that is allocated for that purpose.

However, the list and the general direction as a whole is solid. Some things are open for individual discretion.

Commitment of Traders Report/ COT Indicator by abetrades

This is a useful ndicator for people who are leaning towards the side of experienced when it comes to trading.

Getting Better by Reducing What Makes You Worse

There are two ways you can think of getting better at something.

Improving your skillset

Determining and reducing/eliminating anything that is getting in the way of progress.

This second framework can prove useful if you feel like you are plateauing when it comes to investing, trading onchain, trading perps etc.

On Volatility and Taking on Risk

Robot James is an OG of the game. The frameworks he provides can be applied to any approach in a general manner.

This thread is no different. I would urge you to check out his website which has grouped some of his longer form helpful tweets (website in his Twitter bio).

Thoughts on BTC

Sorry Pirates had some technical difficulties with recording a video but here are my detailed thoughts on the market currently.

Let’s keep it simple. BTC has now been ranging for the past ~ 10 days.

That means we play the range until the range is not valid anymore.

Some alts are looking fairly weak and bleeding out against selective alts (RNDR, FIL etc.). This has been fairly obvious this week. Capital has been rotating around.

Here are some levels to keep in mind (also labeled on the chart):

Feb 14-Feb 23

Range 53090 high - 50528 low (Binance Perps)

Value Area

VAH- 52.4

VAL- 51.5

vPoC- 51.8 (Resistance)

Thesis- as long as the range low holds, at a minimum = opportunities on strong/select alts.

For Continuation: PoC demonstrated to be resistance past few days.

Flip of VAL + PoC w/ continued strength on the part of spot would indicate higher Otherwise lower we go.

Current BTC Spot Liquidity (left: Binance Spot, Right: Coinbase)

Orderbook on the right being shown for Binance.

The general theme is ~52-53+ has supply sitting in the books currently.

It will require a push that is backed by spot chasing (spot bidding) to get past the 52+ area. On the left side of the image, you can observe that some people seem to be in a rush to sell lower (labeled sell orders). More spot orders appearing in the Binance book on the sell side.

Conclusion: BTC is currently ranging, play it as such. This ranging behavior (as long as the range low holds) will offer opportunities onchain and on select alts until the trend resumes.

If the range breaks down, there are several areas of interest but I suspect if this current range breaks down we will need to give the market some time to stabilize before continuation.

2: Smart money

Inflows (7d):

Keep reading with a 7-day free trial

Subscribe to Seven c Newsletter to keep reading this post and get 7 days of free access to the full post archives.