Ahoy crypto dwelling pirates, welcome to the eighth addition of the Seven c Newsletter, one of the most concise newsletters to date.

Their are on-going issues with embedding tweets into substack, so each Tweet is a photo which has a link attached to take you to the content.

Contents:

1: News roundup

2: Alpha aggregation

3: Technical roundup

1: News roundup

Is ETH a security or commodity?

EU rules endorsed to trace crypto-asset transfers:

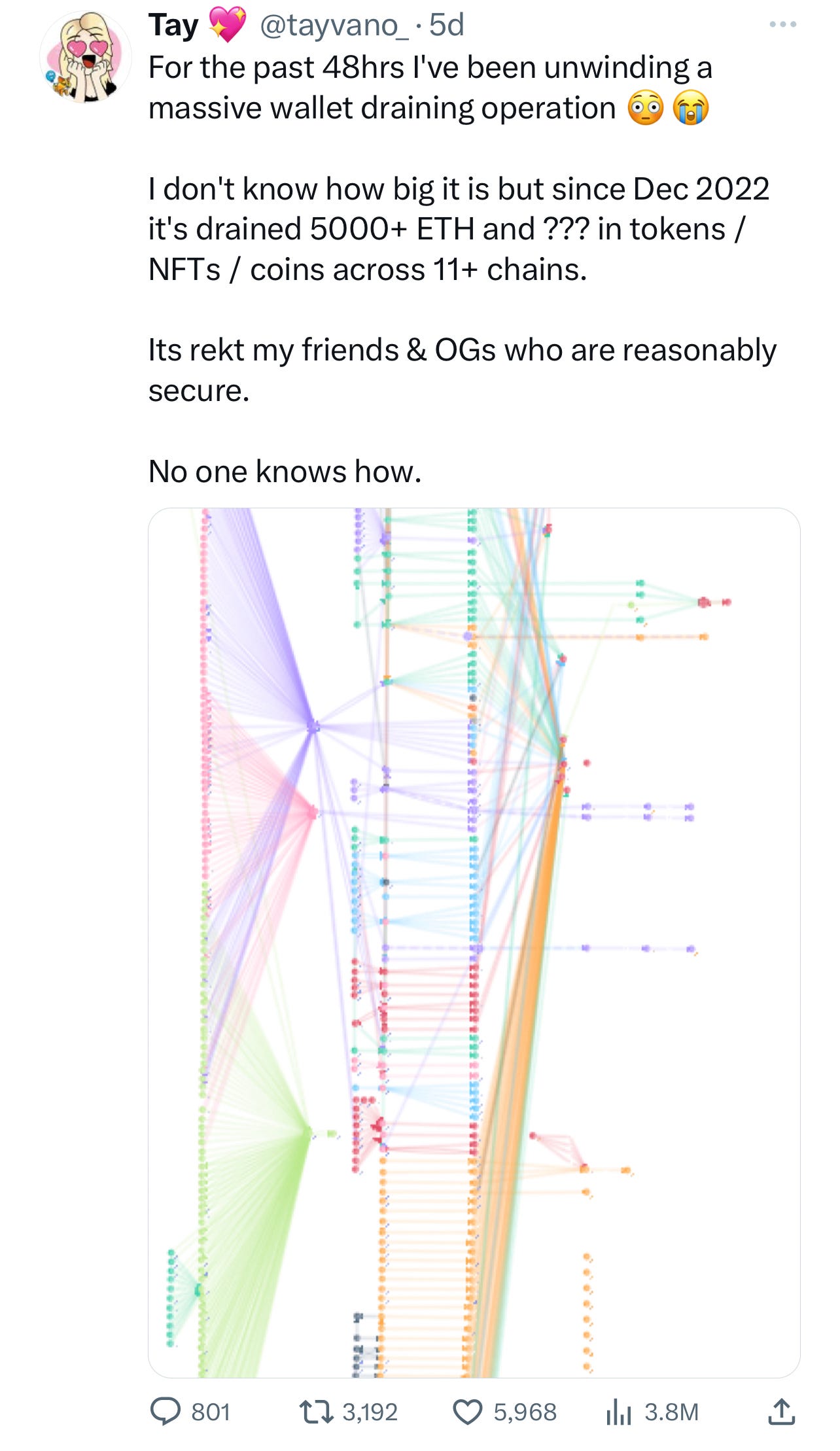

Wallets being drained:

Fed might accept a higher inflation target:

2: Alpha Aggregation

How does Linn find gems? Here’s her toolbox:

Investigations into $PEPE:

Follow the smart money:

What is the tri-token model? What is Berachain?

Using Bubblemaps to investigate $PEPE:

Who are the top VC funds in crypto?

New ethereum liquid staking derivative (SL will be sponsoring me at some point but this isn’t a sponsored spot):

Tokenomics framework:

Nova’s portfolio:

A guide to understanding market structure:

3: Technical roundup

Weekly roundup presented to you by IA crypto | Ijaz Awan:

Find him on Twitter here: Ijaz Awan Twitter

Find him on YouTube here: Ijaz Awan YouTube

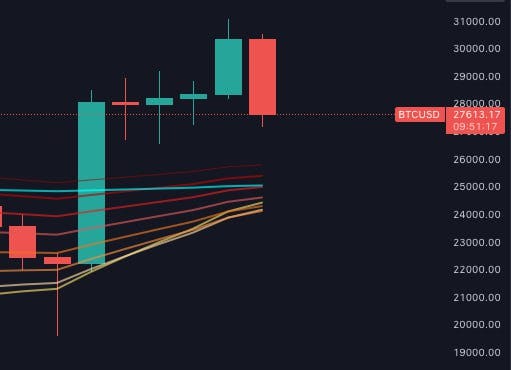

A painful ~9% down week for Bitcoin sees crypto's flagship form a worrying sign on the Weekly Chart. As you can see below a close of the weekly candle later today at these levels will confirm a Bearish Engulfing candle. This is typically an indicator of a reversal and could spell a more prolonged pullback for $BTC.

The top of the Weekly EMA ribbon sees support start to come in around that $25,500 level - which would in my view be a perfect retest of the ribbon and present a lovely buy for me to personally DCA. A close of a weekly candle below $24,400, however, would be hugely damaging and would spell a major trend reversal with Bitcoin losing a grip of its Weekly EMA ribbon.

On the daily chart - this time last week we closed at around $30,000 - and I was sharing with you that a pullback into the EMA ribbon was not only expected but is healthy. I have personally taken the opportunity to start nibbling into DCA opportunities.

The pullback, however, is being pushed to its limits and you can see the price action is using all of the EMA ribbon!

You can see on Saturday $BTC tried to respond with a bounce, but weekend volume remains thin and we must wait till tomorrow to see if the Bears will manage another leg down. A daily close below $27,000 would not be good and will see us lose our Daily EMA ribbon. A strong reaction from the bulls, however, could spell another powerful leg up - but that will not be easy and will require good volume and a move to form a higher high above 31k.

Thursday's Q1 GDP figures and Friday's PCE figures will no doubt play a part in this week's price action.

Another interesting data point is the 4H chart. As shared in my videos throughout the week, if you take the Fibonacci Ratio tool and apply it to our most recent leg up, you see that the golden pocket sits between 26.8k - 27.2k

No surprise that $BTC is trying to bounce from this level - but do bulls have enough legs to keep the move going or is it a relief rally...

Ijaz released an excellent video today on his top 5 crypto trading indicators:

That be that for another week in crypto, I hope you enjoyed this newsletter.

I get a great sense of satisfaction to compile the information together for you guys, I hope that you’re able to learn something every week!