Seven c Newsletter #56 🏴☠️

JUST IN: Your weekly crypto roundup of alpha, airdrops, news, and technicals!

AHOY! Welcome to the 56th edition of your free weekly newsletter covering alpha, airdrops, news, and technicals, but before we dive in, let me tell you about the performance of yesterday’s premium newsletter (this week hasn’t played out yet but there’s a few early winners):

LMR up 18%, ARB up 3%, PANDORA up 6%, DEGEN up 17%, WASD up 16%, DEAI up 53%, VPS up 98%.

OKAY, so if you want to support me for £9.99 a month and gain access to A* information whilst you’re at it then the options there with a free 7 day trial.

Contents:

1: News roundup

2: Technical roundup

3: Alpha aggregation

1: News roundup

US Judge says that grass is green:

BlackRock launching digital liquidity fund:

Ethereum foundation under investigation:

SEC chatting shit:

Why ETH slander is misinformation:

Trade on RabbitX

(RabbitX is an official Seven c Newsletter sponsor)

RabbitX is the fastest, and fastest growing, perpetuals DEX in DeFi. With 20x leverage, no gas fees, deep orderbook liquidity, and the best UX. Also they’re mobile app is amazing and the team is based. Back The Bunny.

Trade now: bit.ly/rabbitx-hoeem

2: Technical roundup

Weekly roundup presented to you by Duck & Cred (aka, a link to their incredible show)! I have been getting immense value from their weekly shows so this is a must watch:

3: Alpha Aggregation

FriendTech B2 incoming:

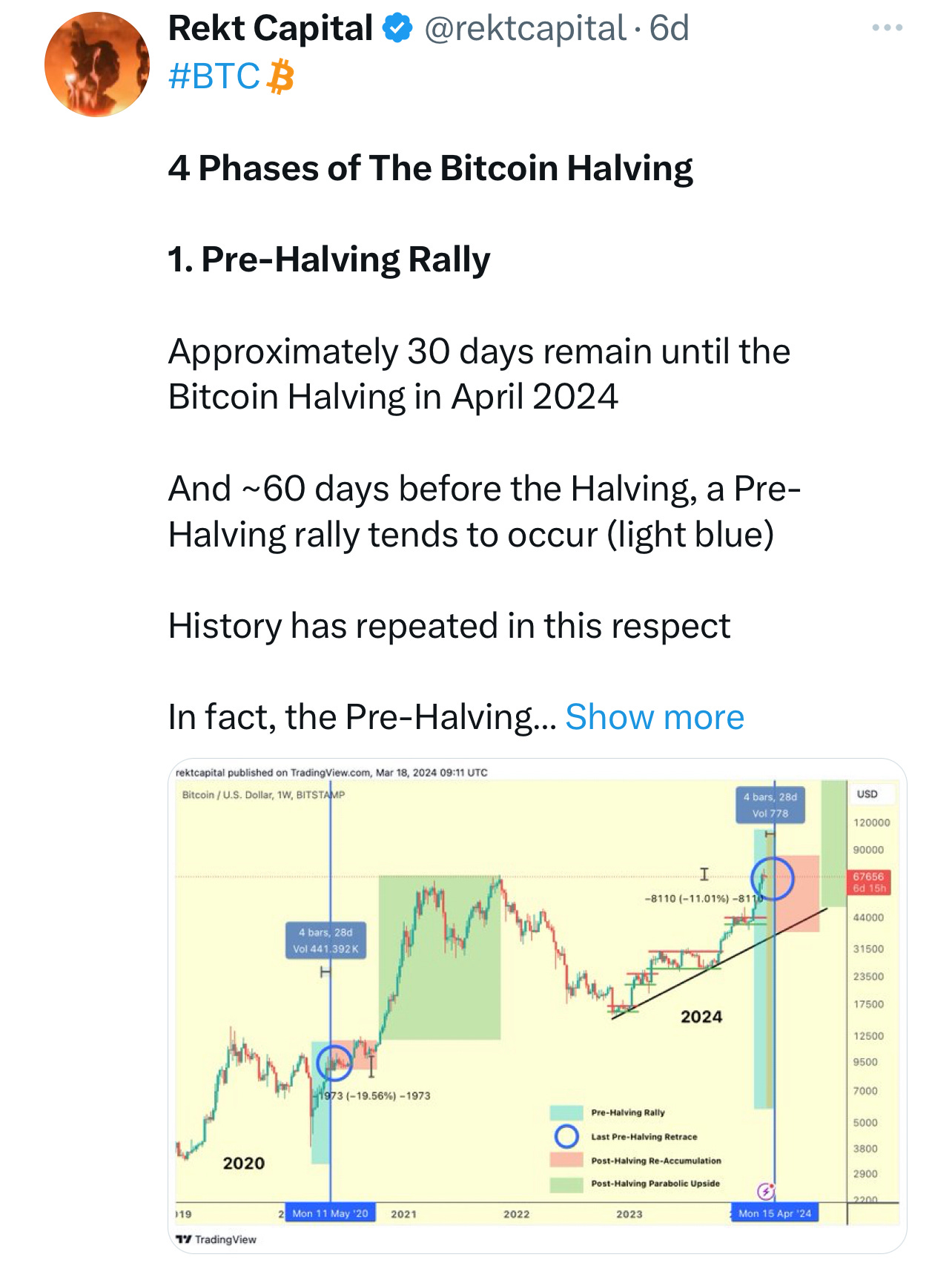

Phases of the BTC halving:

Suddenly hearing about $FTM?

Be early to BASE:

Mistakes you make when trading:

Modular Ecosystem Map:

Alts that look ready to send:

Understanding airdrops with data:

Gearbox alpha:

Izu’s list of crypto projects:

House money effect in crypto:

Parifi public sale (Seven c Newsletter sponsor):

Perps, perps, perps - have we seen it all? Far from it.

Parifi addresses the competitive perps market by solving key issues like price slippage and inefficient funding rates through its adaptive pricing framework and dynamic fees.

Backed by partners like Pyth, Router Protocol, Tenderly, and Exactly, Parifi leverages Pyth Network's real-time oracle data and innovative liquidity curves to ensure stable, predictable pricing for traders, while enhancing liquidity provider compensation.

Additionally, Parifi stands out by offering auto-compounding vaults for easy reward collection, unlimited trading positions, and simple login via social media or Gmail, catering to all user levels.

BULLISH! Wen token?

Parifi's public sale is taking place between 23rd March 6pm UTC - 26th March 6pm UTC, offering 5.5% of their supply at $0.012 per token, targeting a conservative $12m FDV on a first-come, first-serve basis. To secure your allocation, head over to their website.

Thank you for reading another Seven c Newsletter, I hope it keeps you up to date with elite information to keep you up to date and ahead of the pack on a weekly basis.